Surety addresses inefficiencies and imbalances in fiat-to-crypto markets by introducing a novel decentralised protocol. It combines tokenisation, advanced custody mechanisms, and market-making to create a deeply liquid on-chain ecosystem.

The Problems Surety Solves

Surety tackles three critical inefficiencies in the current crypto-fiat landscape:

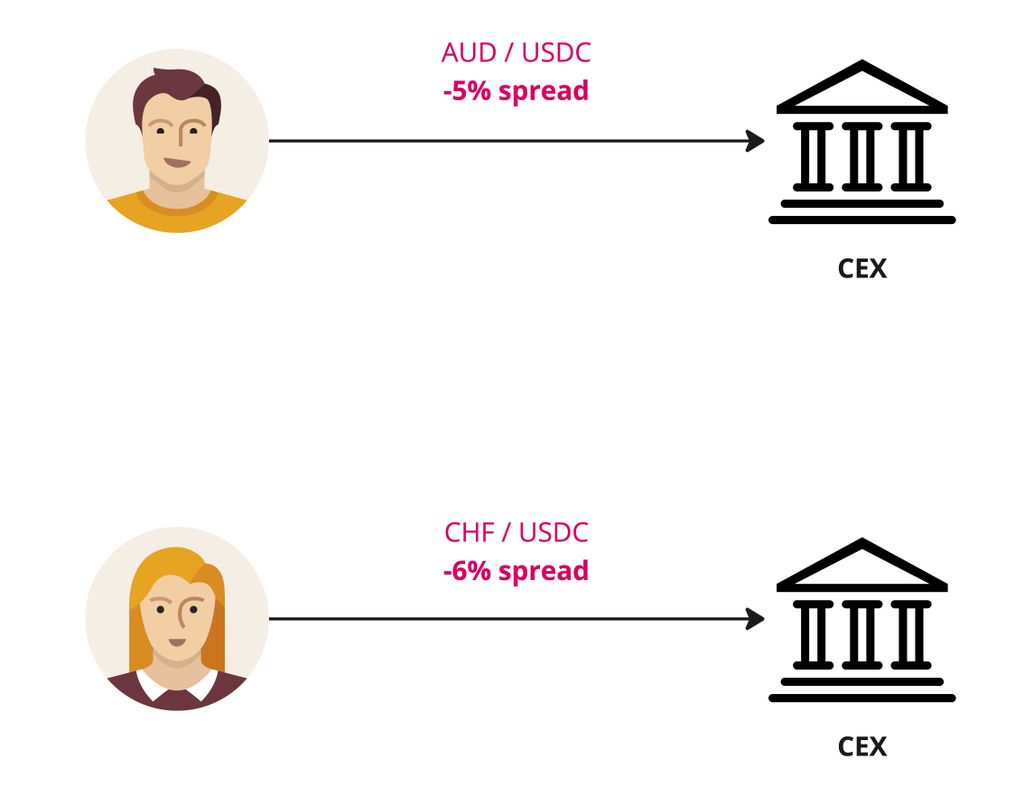

- Fragmented Liquidity Pools: Virtual Asset Service Providers (VASPs), such as centralised exchanges (CEXs), operate in silos, leading to scattered liquidity. This fragmentation increases spreads and costs for converting regional fiat currencies into digital assets.

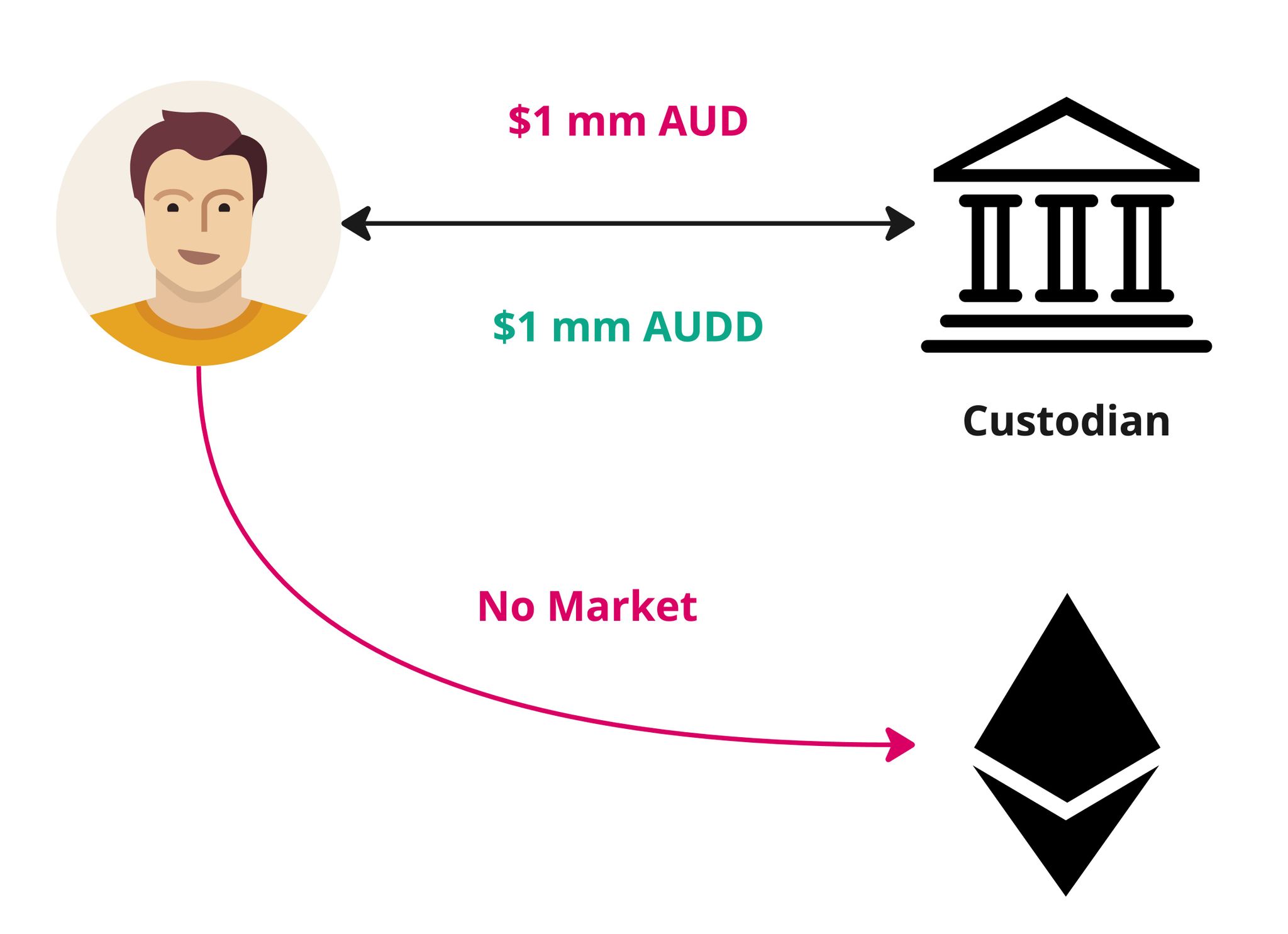

- Underutilised Tokenisation: While technologies exist to tokenise regional fiat currencies, these efforts are hindered by the lack of counterparty markets. As a result, tokenised regional fiat currencies often face limited demand, high spreads, and low competitiveness compared to USD-based stablecoins.

- Negligible Crypto-Backed Foreign Exchange: Despite traditional finance processing $7.5 trillion in daily forex volume, crypto-backed foreign exchange accounts for just 0.00003% of that figure—roughly $810 million annually. This stark disparity reflects inefficiencies in crypto-based liquidity and exchange systems.

Even with the success of USD-focused stablecoins like Tether and Circle (exceeding $200 billion in valuation), other fiat currencies are neglected, exacerbating global accessibility challenges.

How Surety Works

Surety introduces an innovative protocol with integrated features to solve these inefficiencies:

1. Bridging Liquidity

At the core of the protocol is the Surety Fund (SRF), a digital asset backed by a basket of fiat currencies held by decentralised custodians. These reserves are tokenised using zkTLS custody verification, ensuring transparency and trust in the backing assets.

The SRF is paired with Surety Bond capital, denominated in a ubiquitous stablecoin like USDC, to create market-making pairs (e.g., SRF-USDC) on an embedded decentralised exchange (DEX). This pairing ensures that every tokenised SRF is secured by bond capital, fostering trust and liquidity while narrowing spreads.

2. Minimising Costs

Surety’s integrated DEX offers unique features to address spread inefficiencies:

- Single-Sided Liquidity Provision: Users can contribute either SRF or bond capital, with unmatched deposits pooled until a counterparty is available. This simplifies liquidity participation while maintaining balance.

- Active Liquidity Management: Delegated Liquidity Managers optimise positions, ensuring tight spreads and efficient trading.

By consolidating fiat reserves into a unified pool and incentivising active market-making, Surety reduces costs associated with fragmented liquidity and inefficient tokenisation.

3. Ensuring Security and Trust

Surety employs robust mechanisms to safeguard its ecosystem:

- zkTLS Custody Verification: Cryptographic proofs validate that fiat reserves are securely held by custodians without exposing sensitive data.

- Surety Bonds: Custodians are required to deposit stablecoin capital as insurance against fraud. In cases of custodial misconduct, the protocol liquidates the bond to redeem SRF, protecting token holders from loss.

These mechanisms decentralise trust, reduce reliance on individual custodians, and protect against fraud or liquidity crises.

4. Incentivising Participation

The protocol’s governance and incentive structure is powered by the Surety Governance Token (SRP):

- Governance: SRP holders influence protocol decisions, such as onboarding custodians, adjusting fees, and managing the treasury.

- Economic Rewards: SRP can be staked to earn additional SRP, ensuring long-term engagement and alignment with the protocol’s success.

The Surety Advantage

Surety delivers a transformative solution for the crypto-fiat ecosystem:

- Efficient On/Off-Ramps: Narrow spreads and competitive yields, with up to 20% annual returns on idle fiat reserves and single-token staking of USDC or SRF.

- Global Accessibility: Tokenisation of regional fiat currencies brings the rest of the world’s fiat on-chain.

- Trust and Transparency: Decentralised custody verification and bonded capital ensure reliability and security.

Surety bridges the gap between traditional finance and decentralised ecosystems, enabling cost-effective cross-border and cross-asset value exchange.

Whether you’re an everyday crypto user, a sophisticated trading firm, or a Web3 project, Surety provides a reliable and efficient solution to navigate the financial bridge between fiat and crypto.