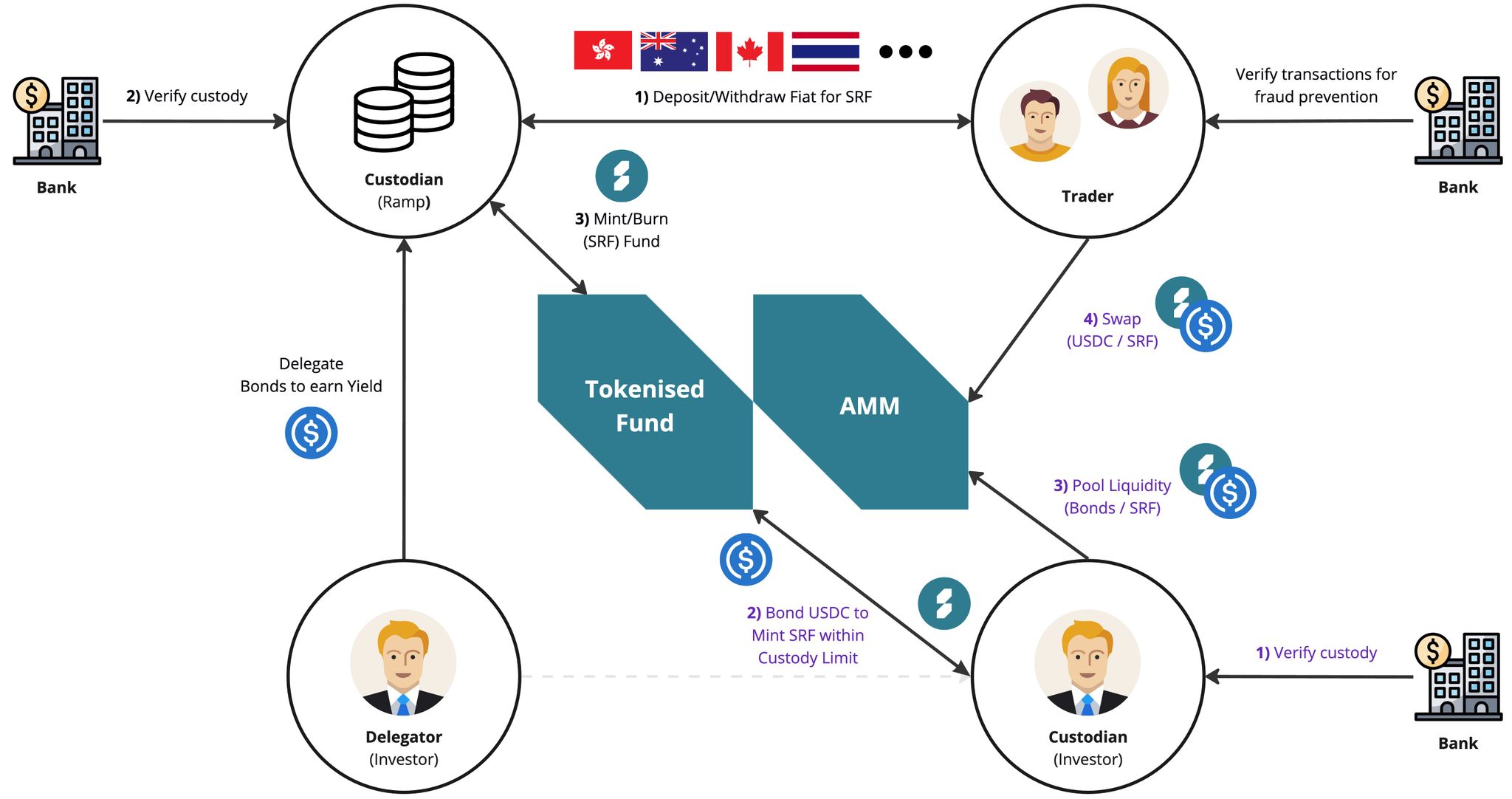

The Surety Protocol operates through a decentralised ecosystem where custodians play a pivotal role in bridging fiat and crypto. Here’s how it works:

Custodians as Gateways to the Surety Fund (SRF)

Custodians serve as the gateway to the SRF by tokenising fiat reserves and managing minting and burning. They ensure that fiat liquidity is securely represented on-chain.

Tokenisation

Custodians tokenise fiat reserves through a transparent and secure process that ensures the integrity of the SRF:

- Custody Verification: Fiat reserves held by the custodian are verified using zkTLS custody proofs, which ensure the validity of the reserves without exposing sensitive financial data.

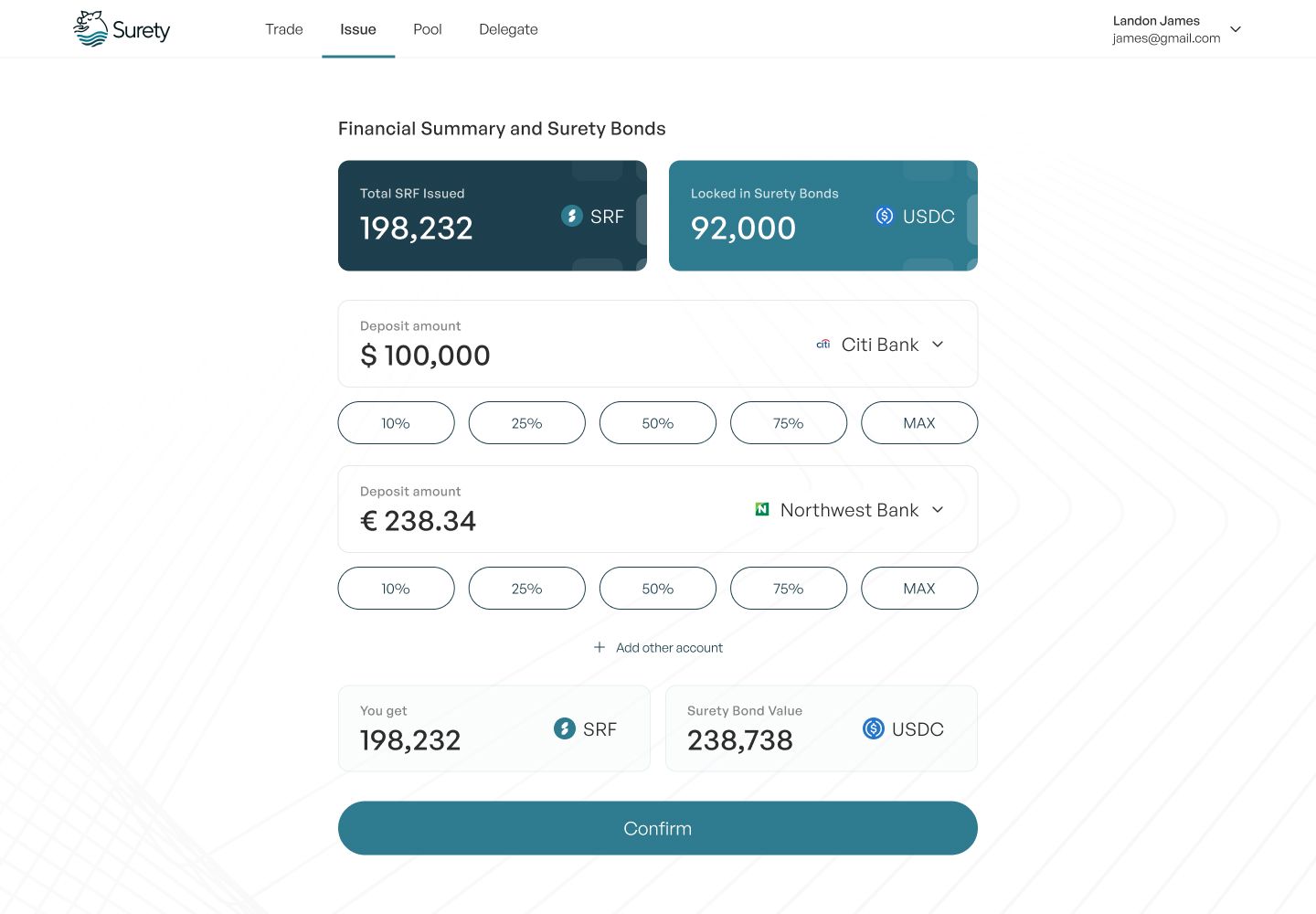

- Surety Bond Capitalisation: The custodian deposits stablecoin capital, typically denominated in USDC, as a Surety Bond. This capital secures the tokenisation process and acts as insurance against fraud or mismanagement.

- Tokenisation Approval: Upon successful custody verification and bond capitalisation, the custodian is authorised to mint SRF tokens.

- SRF Minting: The custodian issues SRF tokens within the limit of bonded fiat reserves, making them available for on-chain use.

- Yield Earning via Staking: Custodians may stake the minted SRF tokens alongside their Surety Bond capital in the protocol’s embedded DEX. By doing so, they contribute to liquidity provision and earn yield on their bond capital, incentivising active participation in the ecosystem.

This dual-layered approach of custody verification and bonded capitalisation ensures both transparency and security in the tokenisation process.

Minting and Burning SRF

Custodians manage the creation and removal of SRF tokens:

- Minting:

- Custody is verified, and an upper minting limit is set based on verified reserves.

- Surety Bonds (USDC capital) are deposited to secure the minting process.

- Custodians mint SRF tokens within the set limit and release them for circulation.

- Burning:

- Custodians verify the SRF to be burned and ensure the transaction aligns with their issued tokens.

- The specified amount of SRF is removed from circulation, and the corresponding reserve is updated.

Licensed Custodians as Custodial Ramps

Some licensed custodians act as Custodial Ramps, enabling fiat-to-SRF and SRF-to-fiat transactions. These ramps play a dual role by holding custody of fiat reserves and facilitating trades for users.

- Custodial Ramps can mint and burn SRF within the scope of their licensed operations.

- They offer additional services, such as:

- Facilitating user onboarding with KYC and AML compliance.

- Setting fees for acquisition and redemption processes.

- They utilise Surety Bonds, backed by external investors, to manage fraud risks and ensure the safety of user funds.

Acquisition and Redemption

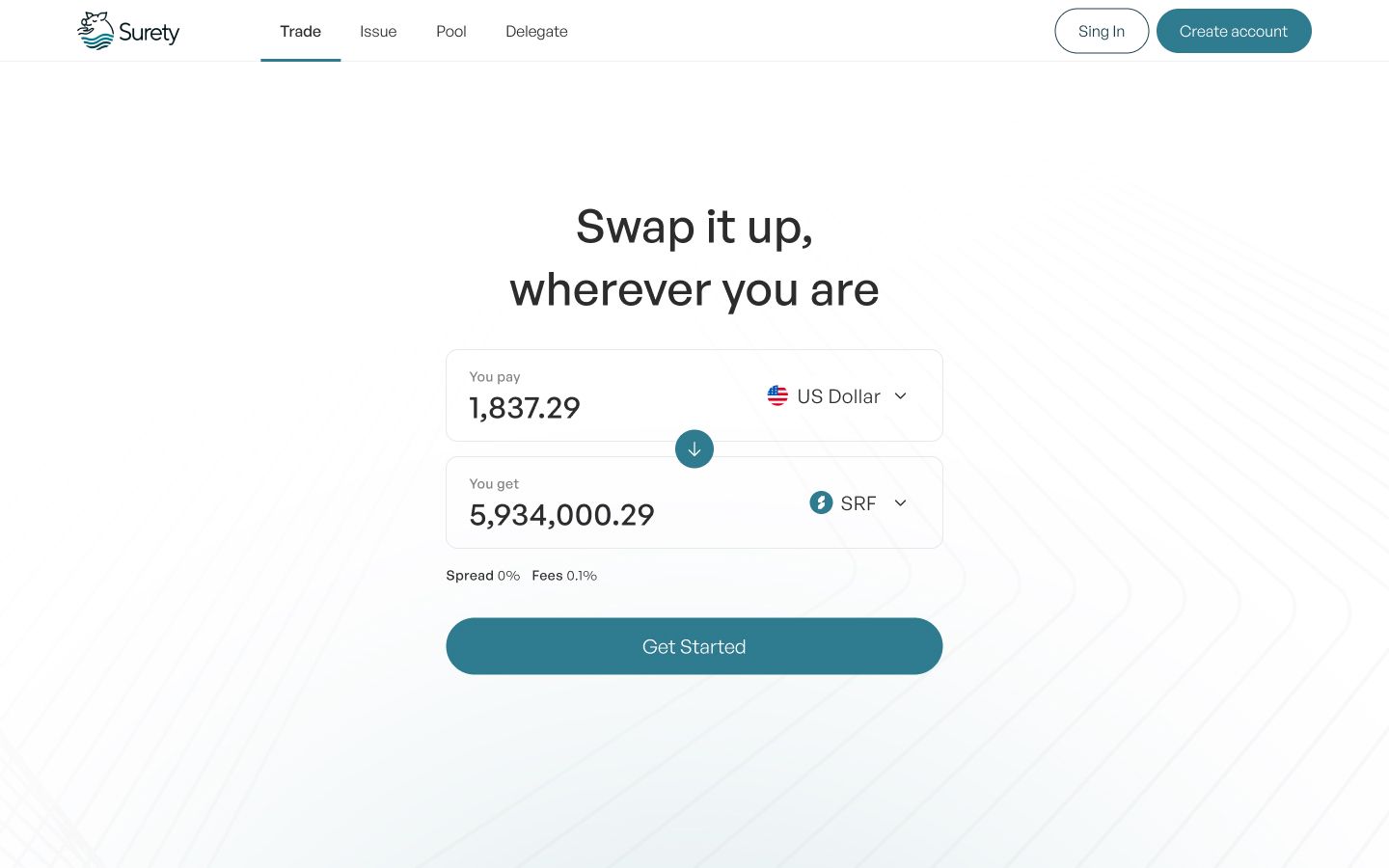

Acquisition and redemption are the core mechanisms for users (Traders) to interact with SRF and fiat currency.

Acquisition (Fiat to SRF)

- Trader Action: A trader engages with a Custodial Ramp and completes KYC to establish a compliant account.

- Fiat Transfer: The trader deposits fiat currency to the Custodial Ramp’s designated bank account.

- Tokenisation: The Custodial Ramp tokenises the fiat into SRF and transfers the tokens to the trader’s crypto wallet.

Redemption (SRF to Fiat)

- Trader Action: The trader initiates a redemption request with the Custodial Ramp.

- SRF Transfer: The trader sends SRF tokens to the Custodial Ramp’s wallet.

- Fiat Conversion: The Custodial Ramp either:

- Utilises its fiat reserves for a capitalised redemption, or

- Converts SRF to fiat through the embedded secondary market in an under-capitalised redemption.

- Fiat Transfer: The fiat currency is deposited into the trader’s nominated bank account.

Value of Decentralised Custodians

By integrating custodians and custodial ramps into its model, the Surety Protocol ensures:

- Trust through decentralised custody and verified reserves.

- Accessibility via licensed ramps for compliant fiat and SRF transactions.

- Efficiency with streamlined acquisition and redemption processes.

Economics Overview of the Surety Fund

The Surety Protocol is designed to maintain stability, fairness, and efficiency across a basket of fiat currencies while incentivising participation. The protocol dynamically adjusts the composition of the Surety Fund (SRF) based on real-time data, ensuring it remains resilient to market changes.

Key Features

- Dynamic Fiat Basket Composition: The SRF represents a basket of fiat currencies, with proportions adjusting elastically based on liquidity, market demand, and exchange rates. This ensures stability and reflects the evolving economic landscape.

- Fair Value Distribution: Deposits and withdrawals are balanced to maintain fairness for all participants. Mechanisms like inflation-adjusted withdrawals protect depositors from value erosion caused by high-inflation currencies.

- Transparency: Decentralised Oracle Networks (DONs) feed accurate foreign exchange (FX) rates into the protocol, ensuring fair valuations for all currencies.

- Rewards for Participation: Liquidity providers, stakers, and custodians earn returns through protocol fees, staking rewards, and yield opportunities, aligning incentives across the ecosystem.

By blending innovative financial models with decentralised governance, Surety ensures the SRF remains secure, equitable, and aligned with global economic realities.